Asset misappropriation can be defined as using company or client assets for personal gain. The two most common sources of occupational fraud are.

Misuse of company resources financial statement manipulation The Public Company Accounting Reform and Investor Protection Act of 2002 is known as the Sarbanes-Oxley Act.

. Cressey 1919-1987 used his doctoral dissertation to study embezzlers whom he called trust violators Upon completion of. Customers Vendors Shareholders Employees 1 poin QUESTION 4 Donald R. Misuse of company resources.

We describe these areas next. Two types of control activities are. The two most common sources of occupational fraud are.

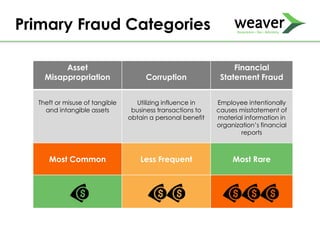

One element common to most occupational fraud offenders from the CEO to the rank-and-file employee is that almost none of them took their jobs for the purpose of committing fraudthey are typically first-time offenders. Misuse of company resources. Asset misappropriations corruption and fraudulent statements.

Click card to see definition. According to a recent study of the three primary categories of occupational fraud asset misappropriations are by far the most common occurring in 89 percent of the cases in the study. Tap card to see definition.

Financial statement fraud was on the other end of the spectrum occurring in less than 10 of cases but causing a median loss of 975000. The ACFE 2014 reports that misappropriation of assets is involved in 87 of cases corruption in 33 of cases and financial statement fraud 8. Occupational fraud as stated can be put into three categories.

Asset Misappropriation is the most common form of occupational fraud but the least costly on average. The ACFE report identifies three categories of fraud. Billing is most common method of fraud in All Cases Check tampering is much more frequent method in small businesses than All Cases Usually involves poor controls over cash disbursements OCCUPATIONAL FRAUD AWARENESS 66 OCCUPATIONAL FRAUD AWARENESS 2008 Victim Organizations Methods of Fraud Small Business vs.

In con- trast only 9 of cases involved financial statement fraud but those cases had the greatest financial im- pact with a median loss of 1 million. An obvious answer is greed. Employee misrepresentation to outside stakeholders.

Asset misappropriation and 3. Asset misappropriation corruption and financial statement fraud. Theft of cash services inventory time or intellectual property falsified expense reports purchase order schemes in which payments are made to false vendors credit card abuse in which a company card is used for personal expenses cheque forgery and tampering falsified sales with the intention of collecting commissions on those sales.

To aide in this effort the ACFE has developed a fraud tree that categorizes and organizes occupational fraud into three main categories. The types of cases are noncash 21 percent billing 20 percent expense reimbursement 14 percent check and payment tampering 12 percent cash larceny 11 percent and payroll 7 percent. Which of the following led to the passage of the Sarbanes-Oxley Act of 2002.

Asset misappropriation corruption and financial statement fraud. Facing that fact one must ask the logical question. However they are also the least costly causing a median loss of 114000.

How do good people go bad. Of these asset misappropriations are the most common occurring in 85 of the cases in our study as well as the least costly causing a median loss of 130000. Asset misappropriations are still by far.

Although it is the most common it is typically the least costly causing a median loss of 130000. Asset misappropriation was by far the most common form of occupational fraud occurring in more than 83 of cases but causing the smallest median loss of 125000. The most recent edition of The Association of Certified Fraud Examiners ACFE Report to the Nations on Occupational Fraud and Abuse issued in 2012 states that the median loss of each instance of employee fraud in their study was 140000.

Financial statement fraud is actually quite rare compared to the other categories so this article will focus on the other two. More than one-fifth of these cases caused losses of at least 1 million. However financial statement fraud led to much greater median losses 800000 versus 114K median loss in asset misappropriation.

READ MORE Posted in News Roundup Tagged Fraud. Financial statement fraud 2. There are two main categories of asset misappropriation.

To the Nation on Occupational Fraud and Abuse published in 1996 the association found there were three principal illegal schemes committed against organizations. - personal tax evasion - employee misrepresentation to outside stakeholders - financial statement manipulation - misuse of company resources - financial statement manipulation - misuse of company resources. According to the ACFEs 2018 Report to the Nations on Occupational Fraud and Abuse the largest source of tips that fraud is occurring comes from.

Asset misappropriation is the most common occurring in more than 85 of cases analyzed for the Report. Although the average loss of each fraud case is low asset misappropriation is the most common type of occupational fraud committed. It occurs when an employee improperly uses an employers asset for personal use.

Asset misappropriation was the most common type of fraud and occurred 89 of the time. Of those check and payment tampering represents the highest median loss at 150000. Asset misappropriation corruption and financial statement fraud.

There are 3 primary categories of fraud. Fraud The two most common sources of occupational fraud are. This is also known as stealing.

Fraud Who Can You Trust Ppt Download

Pdf The Role Of Auditing Profession In Detecting Frauds In Financial Statements

7 Worst Accounting Scandals In U S History University Of Nevada Reno

0 Comments